estate tax changes in 2025

Unlike many states there is no personal property tax in New York. How much one pays in estate taxes depends on the size of the estate how the assets are titled and what happens to.

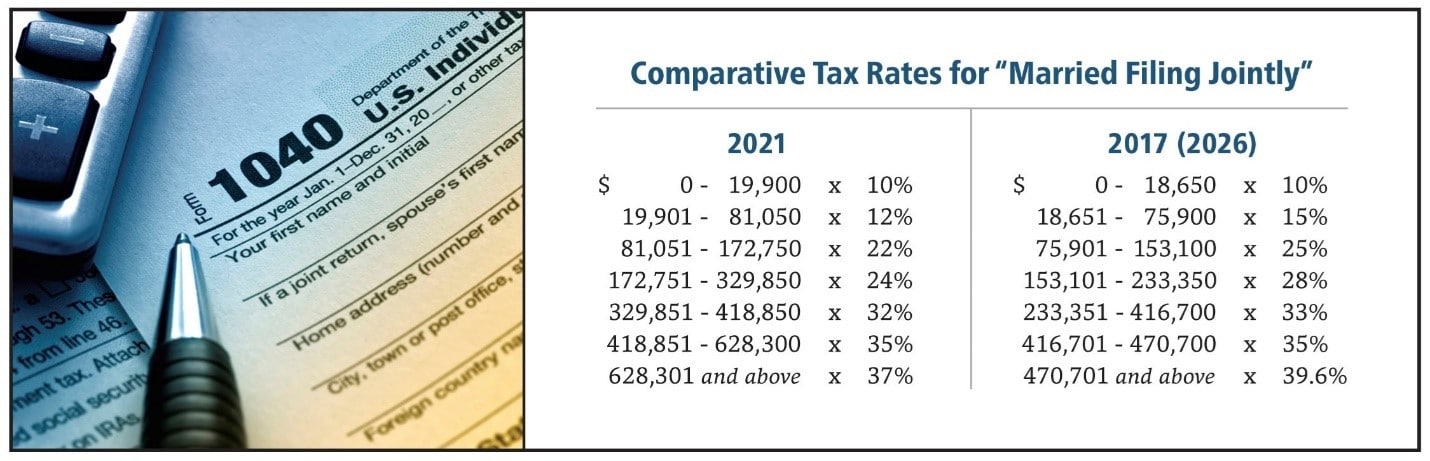

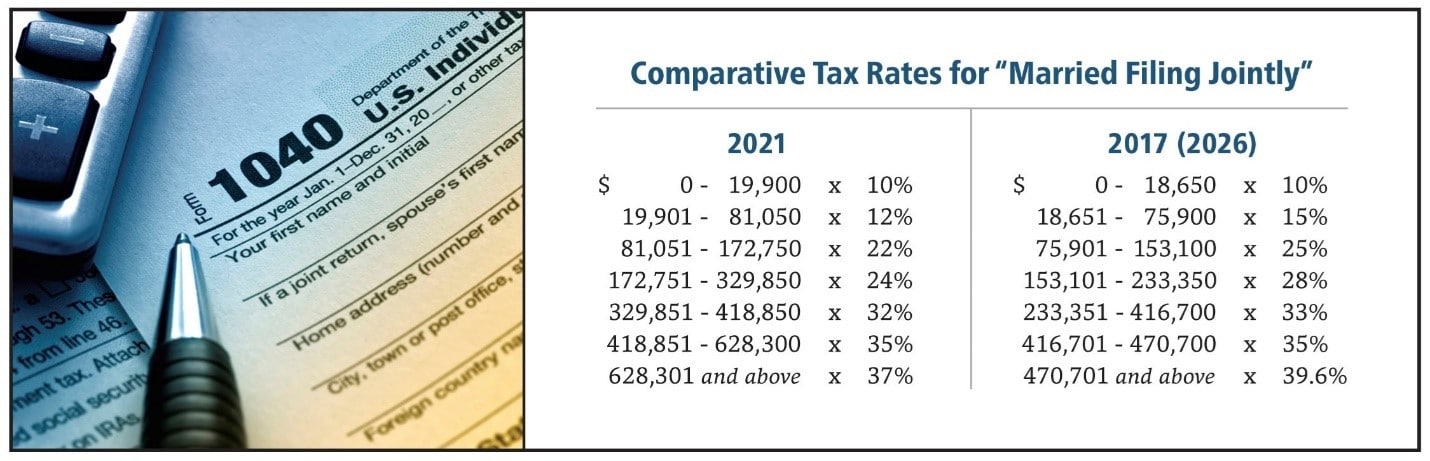

Income Tax Law Changes What Advisors Need To Know

This is the amount one person can pass gift and estate tax free during their life or upon death.

. At a tax rate of 40 thats a 72 million tax bill. When this tax act expires in 2025 the current 1206 million exemption which is inflation indexed and could be closer to 13 million at the end of 2025 falls to roughly 65. The estate tax is imposed on bequests at death as well as inter-vivos during life gifts.

The current estate and gift tax exemption is scheduled to end on the last day of 2025. New estate tax change 5-year Share this. Where the property tax.

That could result in your estate. Rather than taxing items such as jewelry and vehicles only real property is taxed. Additionally in 10 years the gift and estate tax exemption will have likely reverted back to the lower 549 million amount for dates after 2025.

Stephen Pompeo Member 18 Newton Road term expires 312025 5000. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

For Sale - 149 Maple St Medford NY - 495000. The truth is that a revocable living trust alone cannot save estate taxes. Real Estate Assessment Database.

View details map and photos of this single family property with 3 bedrooms and 1 total baths. This is the amount one person can pass gift and estate tax free. Click to share on Twitter Opens in new window.

Ad Aggressive Effective. The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. See what makes us different.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The current estate and gift tax exemption is scheduled sunset on the. With proper trust provisions a married couple could pass 2412 million.

A certain amount of each estate 5. We dont make judgments or prescribe specific policies. Ad Experienced and Trust Litigation from Every Stage of Estate Litigation.

This increase expires after 2025. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. After that the exemption amount will drop back down to the prior laws 5 million cap.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The estate tax exclusion has increased to 1206 million. The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per couple adjusted.

Estate Tax Exclusion Changes Now and in 2025. WASHINGTON Today the IRS announced that individuals taking advantage of the increased gift and estate tax exclusion amounts in effect from 2018 to 2025 will not be. Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified.

Ad Fisher Investments has 40 years of helping thousands of investors and their families. Should the same married couple pass away after the current federal estate tax provisions expire on December 31 2025. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018.

Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions.

The combined state and federal estate tax liability. If this occurs and his plans to reduce the exemption to 3500000 with an increased maximum tax rate of 45 are passed it could add an additional 1410000 in. FY22 Classification Hearing Presentation 121421.

2 days agoLegal Ease.

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Start Planning Now For A Higher Tax Environment Pay Taxes Later

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Final Regulations Confirm No Estate Tax Clawback Center For Agricultural Law And Taxation

2022 State Tax Reform State Tax Relief Rebate Checks

Tax And Financial Planning Strategies To Preserve Wealth

Biden Businesses Tax Collections Would Be Highest In 40 Plus Years

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2022 Updates To Estate And Gift Taxes Burner Law Group

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

What Are The Economic Effects Of The Tax Cuts And Jobs Act Tax Policy Center